Sign up by clicking on the button below to receive future Category Insights & Outlook reports, the latest news, trends, and insights on the world of procurement and supply chain from our experts straight to your inbox.

Category Insights & Outlook 2023 h2

Metals

The metals market remains highly volatile in the face of multiple macroeconomic pressures.

On the supply side, geopolitical issues and natural disasters have disturbed supply chain logistics. On the demand side, widely incorporated ESG practices have affected the manufacturing industry, and potential economic recessions could lower consumer demand and therefore impact the demand for metal from manufacturing. Metal prices are expected to ease over the remainder of the year but will remain subject to volatility over the medium term.*

* Note that this data and related contents refer to circumstances as of end of September 2023.

Trends to date

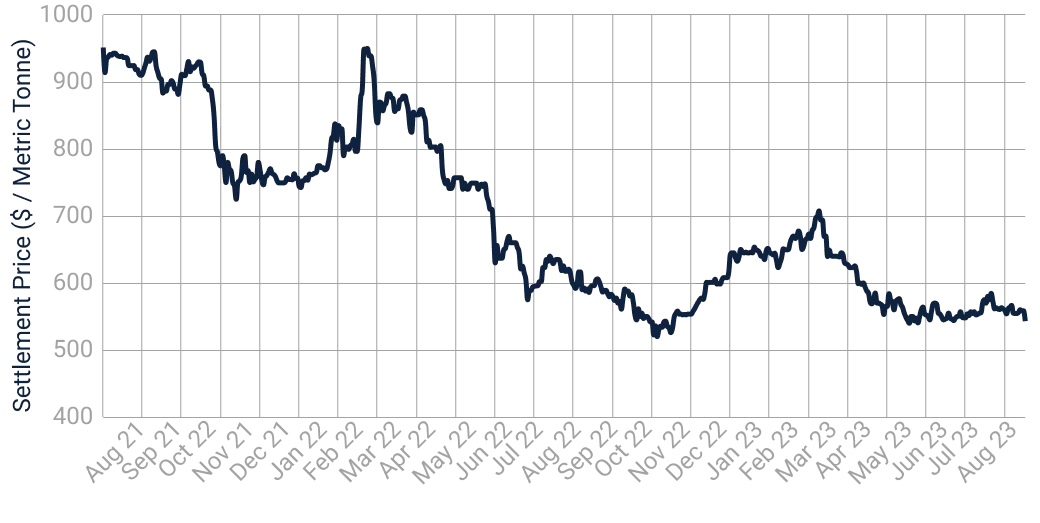

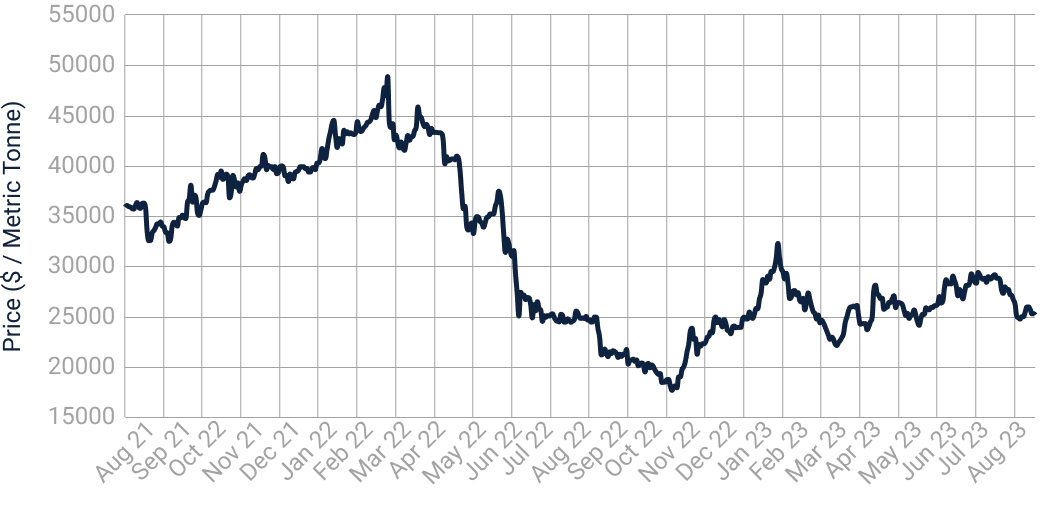

Steel

-11.92% YoY change (Aug 2022 to Aug 2023)

- After a slight rise at the beginning of 2023, steel prices have declined since the end of March due to a weakening of global demand.

- One reason for this decline has been attributed to consumers adopting a more cautious approach to steel procurement in anticipation of even greater reduction in prices.

- In response, several European countries reduced their steel production in the first quarter of this year (Germany decreased by 6.65% YoY and Italy by 6%).1

1 GMK

Price of Steel

Fig. 1: “LME-Steel HRC FOB CN Argus Continuous, Settlement Price ($ / Metric Tonne)” (August 2021 to August 2023), Refinitiv Eikon

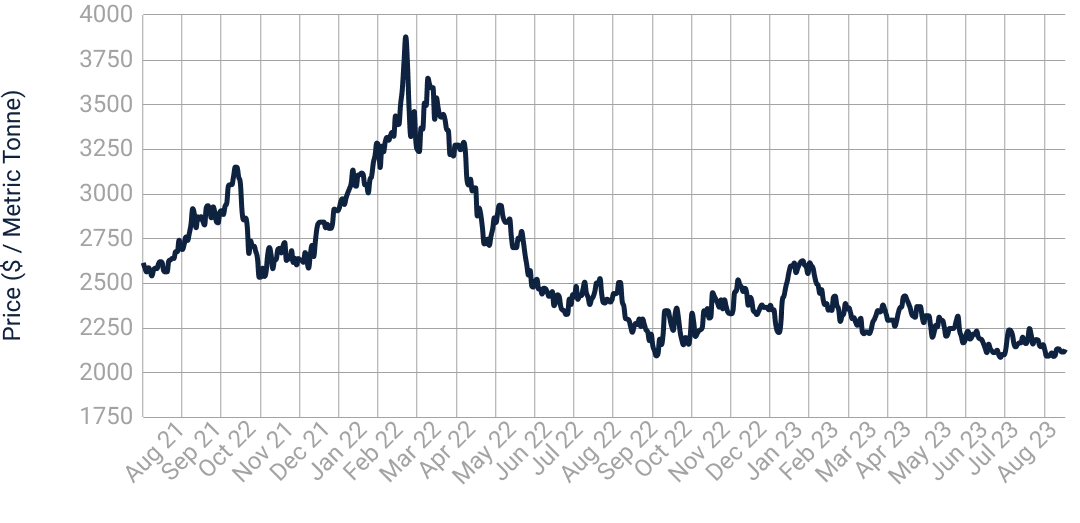

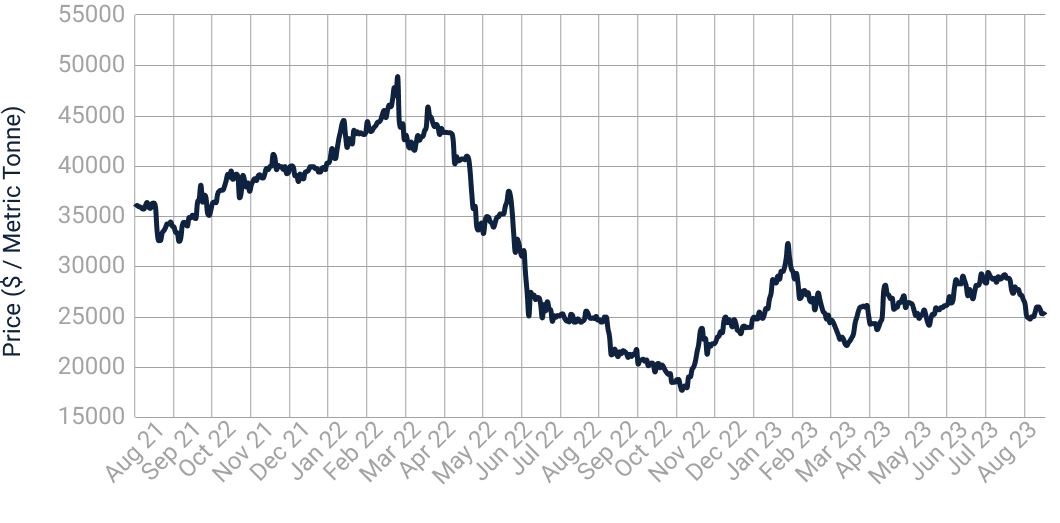

Aluminium

-14.95% YoY change (Aug 2022 to Aug 2023)

- A ramp-up in Chinese production at the start of 2023 – a 3.4% increase from the equivalent time in 2022 – accounted for the drop in price of aluminium.2

- This was compounded by fears of a global economic slowdown that is weighing heavily on many companies.

- The price of aluminium has continued to fall since January 2023.3 Prices are expected to start rising towards the end of the year as China’s real estate sector is expected to start picking up and making a recovery.4

2 Fastmarkets

3 Reuters

4 Mining Weekly

Price of Aluminium

Fig. 2: “London Metal Exchange (LME)-Aluminium 99.7% Cash ($ / Metric Tonne)” (August 2021 to August 2023), Refinitiv Eikon

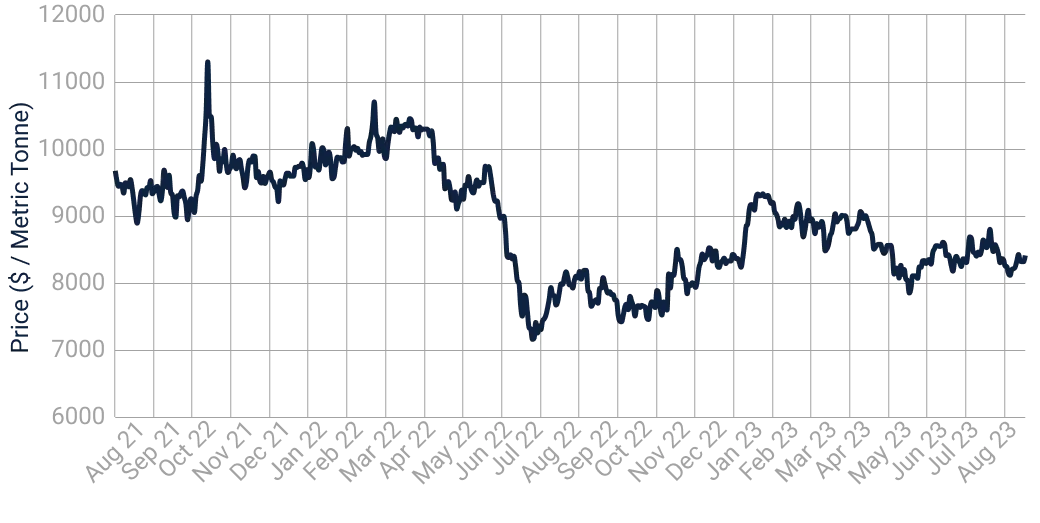

Copper

+2.72% YoY change (Aug 2022 to Aug 2023)

- Prices have fallen since January 2023 as a result of the slowing of manufacturing activity and reduced industrial profits in China. China accounts for half the global consumption of copper.5

- The beginning of 2023 has seen a surplus of 287k metric tons of copper, compared to 74k metric tons in the same period in 2022.6

- Prices are expected to rise towards the back end of 2023 with a potential for the Chinese market to rebound and bring demand up.

Price of Copper

Fig. 3: “London Metal Exchange (LME) - Copper Grade A Cash ($ / Metric Tonne)” (August 2021 to August 2023), Refinitiv Eikon

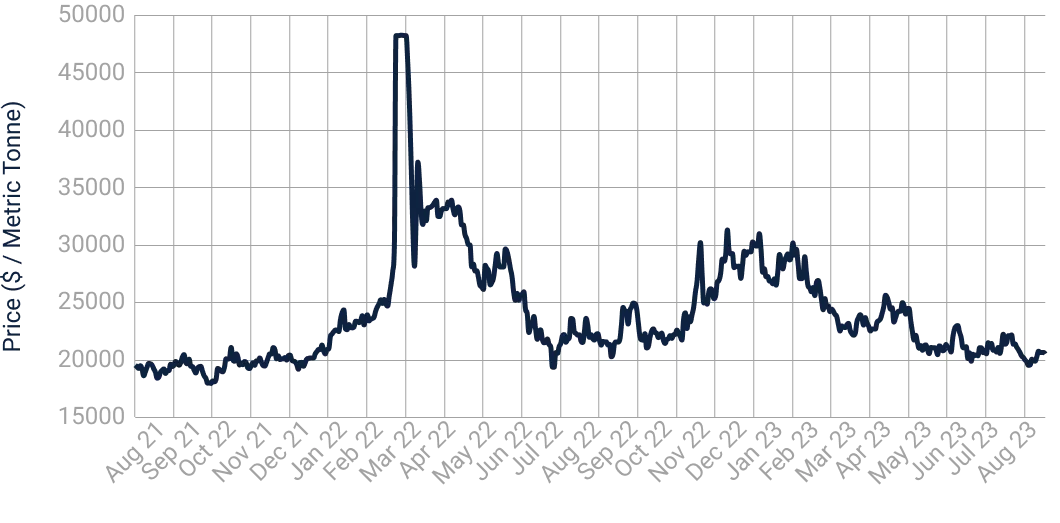

Nickel

-4.89% YoY change (Aug 2022 to Aug 2023)

- Prices decreased by 37% in the first half of 2023, making nickel one of the worst performing metals on the London Metal Exchange.

- Chinese demand for stainless steel (which is the main global use for nickel) has not recovered following the easing of COVID-19 restrictions, with manufacturing activities still not increasing substantially.7

- 2023 has seen a large surplus in supply of approximately 142k metric tons, an increase from 111k metric tons in 2022.

7 ING

Price of Nickel

Fig. 4: “London Metal Exchange (LME) – Nickel Cash ($ / Metric Tonne)” (August 2021 to August 2023), Refinitiv Eikon

Tin

+0.80% YoY change (Aug 2022 to Aug 2023)

- Reduction in soldering demand from the electronics sector led to the fall in tin prices in Q1 of this year.8

- Prices did partially rebound in May 2023 as supply shortages were increasingly anticipated. Continued supply issues are expected, with the prohibition of tin mining in Myanmar and export ban in Indonesia which started 1st August 2023, leading to a significant reduction in supply.9

Price of Tin

Fig. 5: “London Metal Exchange (LME) – Tin 99.85% Cash ($ / Metric Tonne)” (August 2021 to August 2023), Refinitiv Eikon

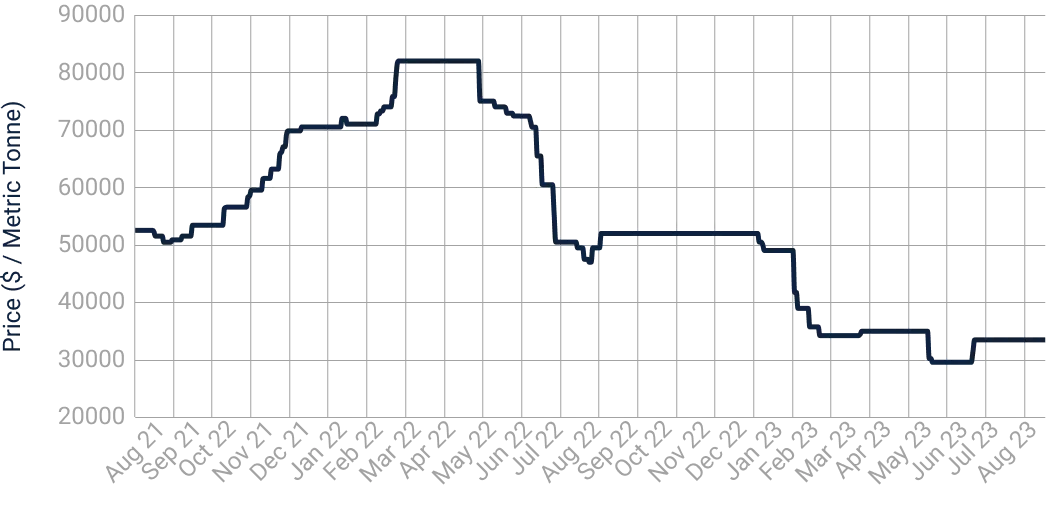

Cobalt

-35.68% YoY change (Aug 2022 to Aug 2023)

• Supply of cobalt has continued to increase as it is a by-product in the process of nickel and copper mining, which are both in high demand this year due to use in electric vehicles and semiconductors.

• The abundance of cobalt supply has led to a significant drop in prices from the start of 2023. Current prices are amongst the lowest they have been since 2019. 10

10 CIPS

Price of Cobalt

Fig. 6: “London Metal Exchange (LME) - Cobalt 3 Month ($ / Metric Tonne)” (August 2021 to August 2023), Refinitiv Eikon

Lithium

-42.76% YoY change (Jun 2022 to Jun 2023)

- Lithium prices dropped substantially in Q1 2023 due to China curbing EV subsidies, which led to a fall in lithium demand and rise in inventory stores.

- Due to the rise in expected demand for EV batteries, for which lithium is a key input material, the oversupply is expected to continue over the next few years.11

11 Reuters

Price of Lithium

Fig. 7: “Lithium Metal = 99%, Industrial Grade, Battery Grade Domestic (¥ / Metric Tonne)” (June 2021 to June 2023), Refinitiv Eikon

Future outlook

Overall, metal prices are forecast to fall by 8% in 2023 and a further 3% in 2024.12 Prices are expected to remain volatile, although many have been easing with the recovering Chinese economy.

12 World Bank

Short term

- As fiscal policy tightens across OECD countries and manufacturing activity in the US slows, steel rebar prices may decline further due to reduced demand.13 China’s debt market and resulting credit constraints will likely lower demand of the metal in H2 2023.14

- Aluminium demand is expected to moderately decline in 2023 due to reduced construction activity in Europe and a weaker property market in China, though the latter may experience an increase in demand towards the back end of 2023. Price volatility will likely continue with the Russia-Ukraine war expected to continue.15, 16

- Nickel prices are expected to decline by 11-15% given oversupply.17

- Copper is expected to increase production and demand until 2024 by ~2.5-3.1%. In the UK and EU, copper demand is forecast to increase by 1.8% in 2023 while China will likely see a CAGR of 2.9%.18 With increased demand for the metal, prices are expected to increase in the short term.

- Tin prices are anticipated to increase due to the prohibition of tin mining in Myanmar and export ban in Indonesia, starting 1 August 2023.19

- Lithium is expected to continue to drop within the next 12 months. By the end of Q2 2023, prices are expected to drop slightly but remain elevated overall for the coming year compared to pre-pandemic levels.20

13 Capital, GMK, Capital, Gensteel

14 World Bank

15 Capital

16 Shanghai Metals Market

17 World Bank

18 IWCC

19 TradingEconomics

20 Trading Economics

Medium term

• While overall prices are expected to ease this year, buyers will face continued instability in the price of metal over the next three years. This hinders buyer power and will challenge the market to budget for purchases.21

• The aluminium price is expected to remain elevated for the next few years with demand high due to green energy investments.22

• Strong demand from the green energy industry and electric vehicles will likely lead to a lasting tightness in tin supply.23

21 World Bank

22 Capital

23 TradingEconomics

Dos, Don'ts, and Best Practices

Dos:

- Consider renegotiating prices for certain metals.

- Run an impact assessment and estimate exposure and dependencies.

- Prioritise initial supply continuity and consider inventory / planning levers.

- Look for alternative local and international suppliers (producers/traders) to limit exposure and expand the supplier base.

- Treat this as an opportunity to optimise and reduce.

- Pass through costs where possible.

Don'ts:

- Do not accept increases if they are not made transparent; determine if they are justified and agree on the conditions for accepting them.

- Do not rush – assess risks, opportunities, and create short-, medium-, and long-term strategies.

- Do not treat the category in silo – identify basketing opportunities depending on metals type.

BEST PRACTICES:

Understand the price breakdown:

- Understand the underlying price indices and establish what is covered by the premium/discount.

- Create full transparency across your procurement costs and supply chain impacts.

- Conduct should-cost analyses for a detailed understanding of the cost drivers and the impact of index development.

- Establish the current state of contract administration, ensuring skilled personnel is at hand to hedge prices.

Short term – Ensure supply and prepare mitigation of risk:

- Confirm exposure to unavailability of supply and/or index price volatility.

- Consider investing in upstream resources to guarantee supply.

- Thoroughly prepare for negotiations with business-critical supply partners.

Long term – Manage volatility impact and boost resilience:

- Review long-term procurement strategy.

- Ensure the right internal and external capabilities.

- Explore risk management strategies.

Key takeaways

- Renegotiate pricing with the key suppliers, as the prices for several metals will be going down.

- Negotiate longer-term contracts with suppliers to mitigate future supply shortages.

- Consider restructuring the supply base by going regional or exploring suppliers in the regions with expanding production capacities that will reduce total cost and improve supply chain agility.

Contact us

How Efficio can help

If your business is or has been impacted by any of these trends, or you would like to dive deeper into the outlook and associated guidance for any of the above categories, our subject matter experts are available to help.

Contact usSign up