Bridging the gap: Part 2

To successfully achieve ESG targets, we face many hurdles that will require consumers, businesses, and governments to come together – consumers to create the demand, businesses to innovate the solution, and governments to remove market barriers and inequalities.

Sustainability also competes against many other critical objectives for limited resources in terms of time and money. Through our research, we have started to understand some of the barriers to the scale and pace of change.

Competing priorities

As Business Leaders grapple with the changing nature of their organisation’s strategic priorities, business functions within them, including Procurement, must also adapt to these shifts.

Procurement teams have a longstanding remit to deliver cost benefit and ensure supply chain resilience. It is therefore unsurprising that Procurement Professionals are still most likely to identify these two facets as their team’s measure of success (66%). In comparison, ESG issues such as establishing the environmental sustainability of the supply chain (44%) and carbon neutrality of the supply chain (28%) feature further down the list as measures of success in the teams.

Our research finds a clear disparity between the reality of the CPO, compared to other Procurement Professionals. For example, while almost three in five (59%) CPOs state that their team captures metrics to measure success that are related to environmental sustainability in their supply chain, the average among all Procurement Professionals is 38%.

This may be a representation of the greater level of oversight and visionary perception that CPOs have of the whole function. However, we believe it’s likely the opposite: CPOs are having to be too focussed on compliance-based metrics and not the core ESG issues and opportunities that the teams can see from interacting with the goods and services on a daily basis.

To enable the sustainability agenda to progress, “We need to activate a change programme for society. This starts with innovators developing great ideas that shift life away from fossil fuels. Private companies and public money need to support this group and their innovations. The regulator must ensure these great ideas make it to market, and consumers have to buy this stuff. We need to change our individual behaviours."

Q. IN WHICH AREAS DO YOU CAPTURE METRICS TO MEASURE THE SUCCESS OF YOUR TEAM?

(Procurement Professionals)

FIGURE 5:

Cost benefit to the wider organisation and quality of sourcing are the key factors procurement teams are assessed against – fewer than two in five are measured against the sustainability of the supply chain

External pressures and the macro environment

As outlined in Part 1, there is great potential for Procurement to address ESG factors within the supply chain. However, there also needs to be a recognition of the reality of the current market environment. Against the backdrop of the pandemic, Brexit, ongoing US-China trade tensions, and the war in Ukraine, global supply chains have faced extreme levels of disruption. Many procurement teams are facing a pinch point.

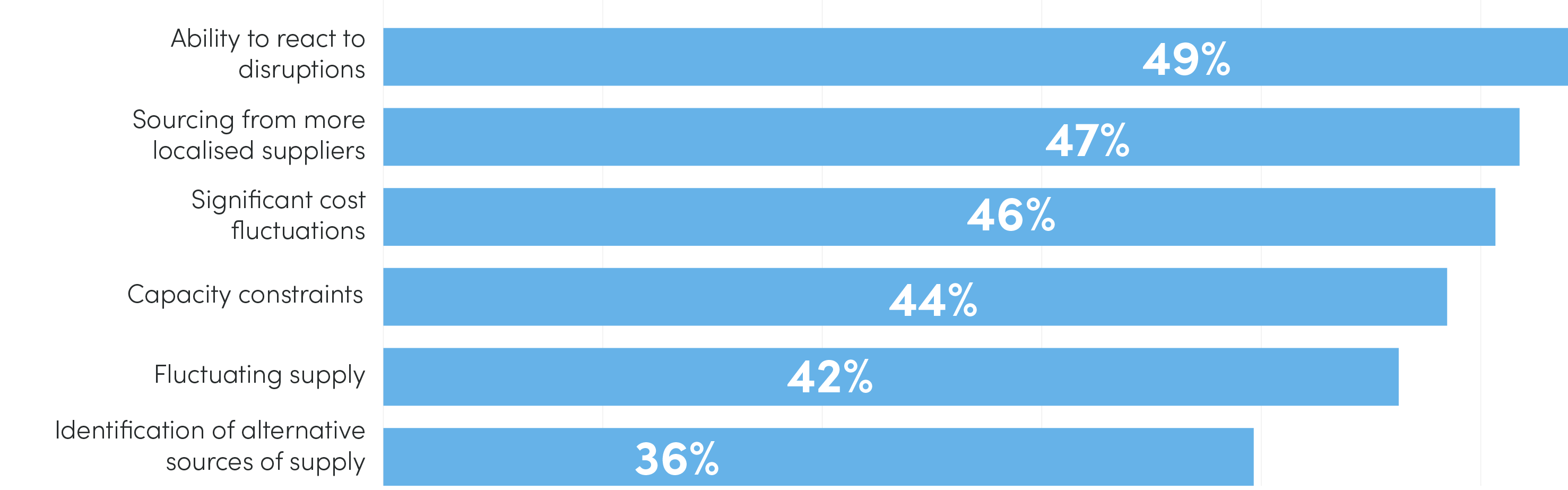

Business Leaders identify a wide range of supply chain challenges: almost half (49%) acknowledge that their business is struggling to adapt to supply chain disruptions, 47% see sourcing from more localised suppliers as a challenge, and 46% are facing significant cost fluctuations.

At the time of this report, the situation in Ukraine remains of real concern for many Businesses Leaders and Procurement Professionals. As with any conflict, there is a risk of further escalation, and the situation remains volatile.

Key material shortages are already hitting hard, as are cost increases that are likely to drive inflation up to double digits in many parts of the world. In this context, it is easy to see why ESG factors start to take a back seat. But this would be short-sighted – ESG is also part of the solution. Lower and greener energy usage, materials efficiency and supply chain security are all part of a sustainable future not held to ransom by fossil fuel and raw material supply chains.

Cross-border trade and supply chains drive economic efficiencies and often offer a level of global integration and security not achievable through diplomacy. However, government officials in Ukraine have cautioned organisations to be prepared for increased cyber-attacks on business and critical infrastructure in the country 4 and so, as we address more fully in Part 4, one of any organisation’s key tasks will be to establish much better supply chain visibility – particularly beyond tier 1 suppliers. By improving visibility, procurement teams will reap the rewards of being able to react and adapt quickly to unexpected disruptions and macro events.

Q. YOU STATED THAT SUPPLY CHAIN DISRUPTION POSES A SIGNIFICANT CHALLENGE TO YOUR ORGANISATION. WHAT ARE THE SPECIFIC CHALLENGES YOU ARE FACING IN RELATION TO YOUR SUPPLY CHAIN?

(Business Leaders)

FIGURE 6:

In the current market and geopolitical landscape, supply chains are pressed by unexpected disruptions

When immediate existential threats surface, it is natural that businesses react and redirect their energies. If a business does not survive, it is no longer able to support sustainability, regardless of how lofty its ambitions. In some ways, sustainability’s lengthy timelines make it a victim of prioritisation: a smaller issue today will generally outcompete a larger issue tomorrow.

The goal must be for short-term success to merge with long-term sustainability. Chris Johns, CFO at Yorkshire Water, has a clear view on how to start this.

Expert view

Chris Johns

CFO, Yorkshire Water

"YOU HAVE TO KEEP PROMPTING PEOPLE TO THINK ABOUT THE OTHER CONSIDERATIONS OUTSIDE OF COST. IT IS IMPORTANT TO ENCOURAGE PEOPLE TO THINK DIFFERENTLY.”

With decades of experience understanding the tensions between economic growth and environmental sustainability, Professor Ekins shares his insights on how climate change is likely to affect our lives in the coming years and which actions businesses, governments, and individuals can take to mitigate its impact.

Read the full interviewToo much to compute

Viewed through the lens of the triple bottom line (People, Planet, and Profit), Capitals (as Yorkshire Water does), or the UN Sustainable Development Goals (as Lonza and many others do), the subject of sustainability is all-encompassing. As such, it is hard to know where and how to start, too often leading to poor prioritisation, inertia, or a tendency to fall back on easy wins, tick box activities, and management of regulatory risk rather than progressive change.

When we asked about the assessment of third-party suppliers, assessment levels quickly drop off beyond suppliers’ financial strength. By and large, anything not related to financial security tended to be compliance-related – the types of questions that are easy to ask (and risky not to ask) but not generally insightful.

Q. WITH ESG AND SUSTAINABILITY BECOMING MORE IMPORTANT DRIVERS OF BUSINESS VALUE, DO YOU CURRENTLY ASSESS THIRD-PARTY SUPPLIERS AGAINST ANY OF THE FOLLOWING CRITERIA? (PROCUREMENT PROFESSIONALS)

FIGURE 7:

Supply chain environmental and social risk factors are significant lower in priority than suppliers’ financial strength

But this is not typically where businesses and Procurement want to be. It is seen as a low value-adding administrative burden and detracts from efforts to make tangible improvements elsewhere.

In our next interview, Rachel Dolan from Permanent TSB, a leading Irish high-street bank, gives an honest assessment.

Expert view

Rachel Dolan

Head of Procurement and Supplier Relationship Management

Permanent TSB

"LEADERSHIP TEAMS AND STAKEHOLDERS ARE NOW RECOGNISING THE VALUE-ADD OF PROCUREMENT. AS A RESULT, WE ARE SEEING THE PROCUREMENT FUNCTION INCREASINGLY INVOLVED IN THE KEY STRATEGIC INITIATIVES OF THE BUSINESS.”

Permanent TSB Group is a provider of financial services for individuals and businesses in Ireland.

Over the past eight years, Rachel Dolan and her team have transformed Procurement at Permanent TSB into a key enabler of the bank’s key strategic functions. Touching upon the firm’s ESG priorities and Irish market-specific challenges, she discusses the role of procurement in advancing the organisation-wide sustainability agenda.

Strategic and operational disconnect

We have seen in the data that C-suite objectives and expectations do not necessarily correlate with those lower down the chain of command. The C-suite’s understanding of Procurement’s remit also differs from the way those working in the function see their own role and the value they can add to the business.

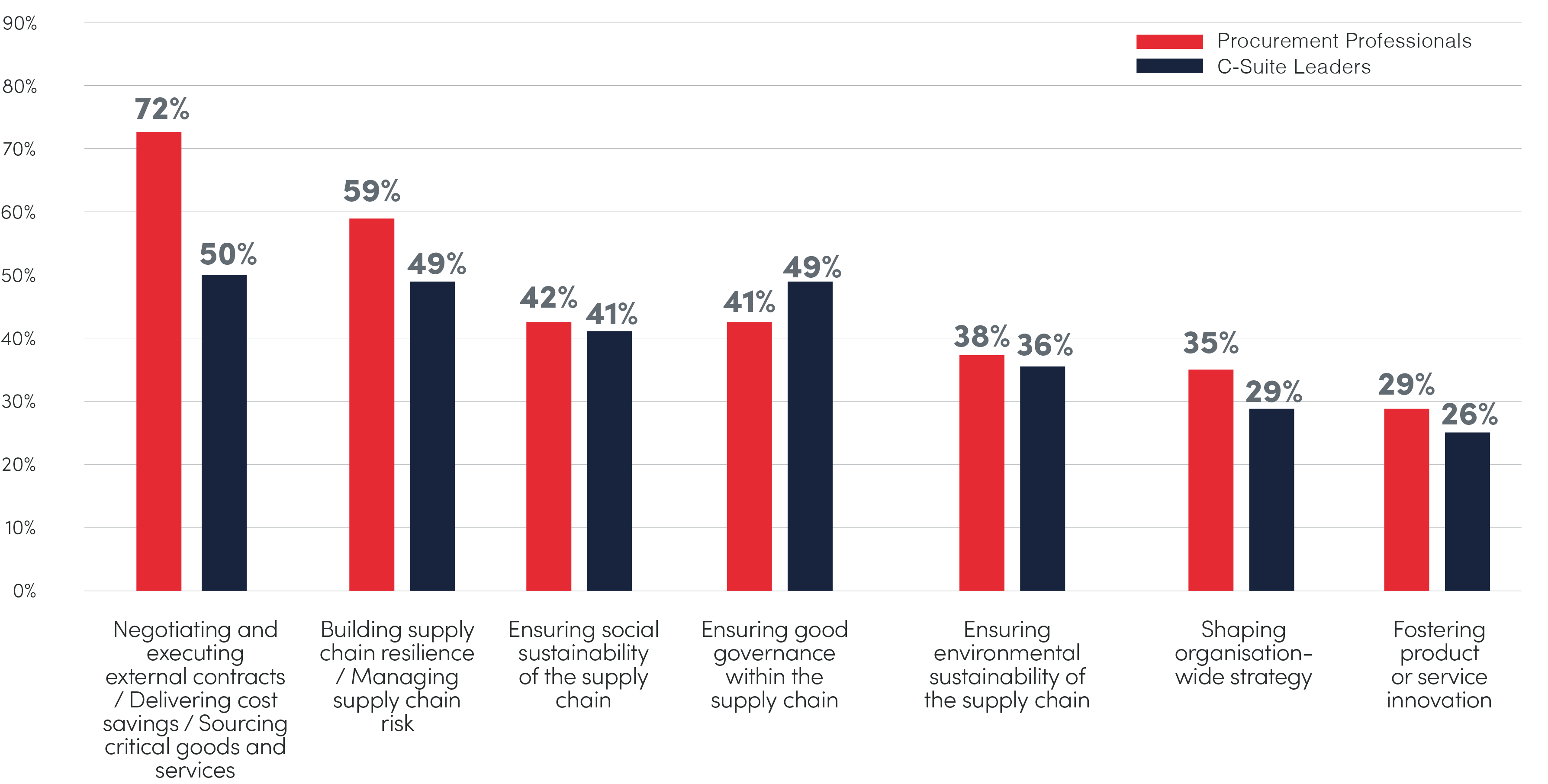

For Procurement Professionals, the traditional procurement asks, such as delivering cost savings, stand out as the top priority, while those in the C-suite are more likely to see Procurement’s remit as spread out across a range of different responsibilities. However, sustainability is clearly not seen as a Procurement priority, with less than half of Procurement professionals and C-suite leaders selecting ESG-related responsibilities as part of the remit of the Procurement function.

Procurement is not widely seen as a strategic function, with only 35% of Procurement Professionals and 29% of C-suite Leaders stating that “shaping organisation-wide strategy” falls within Procurement’s remit.

Q. WHAT IS THE REMIT OF THE PROCUREMENT FUNCTION AT YOUR ORGANISATION?

FIGURE 8:

The C-Suite does not see Procurement’s role in the same way as Procurement Professionals do – this misalignment needs reconciling

When senior visions are not aligned throughout an organisation by being operationalised, resourced, and supported through reinforcing techniques – such as bonus incentives and other positive feedback loops – then objectives will be late, be diminished, or fail.

Without the support of the CEO or equivalent, sustainability does not happen. The CEO has to give encouragement to employees and key business functions to think about these issues. Even better if it is built into promotion rounds and remuneration. It is a question of driving the culture, so that employees also adopt those values and mindset.”

Expert view

Thomas Udesen

Chief Procurement Officer, Bayer

"THE MINDSET OF THE ONE MILLION PROCUREMENT PROFESSIONALS WORLDWIDE NEEDS TO SHIFT. IF YOU CHANGE THE MILLION, YOU SAVE THE PLANET. IT IS THAT SIMPLE"

Bayer is a world leading pharmaceutical and biotechnology company headquartered in Germany, with a global reach. With 20 years’ experience in procurement, Thomas Udesen is well-versed in the wide-ranging challenges of delivering a sustainable supply chain. Bayer has founded two industry initiatives – the “Pharmaceutical Supply Chain Initiative” (PSCI) and “Together for Sustainability” (TfS) – which encourage collaboration across businesses to drive awareness on responsible sourcing practices. Udesen is also a co-founder of the Sustainable Procurement Pledge.

Read the full interviewWHAT OF LEADERSHIP?

Where Procurement is not empowered, who is?

Procurement may be bought into the criticality of ESG and sustainability and pushing to be part of the solution. However, who is currently leading the charge within business? HR certainly play a role with regard to people parameters. Operations and Facilities will look towards energy usage and waste. But these are almost always internally focussed. Sustainability leads will be looking to steer activity, but without a team below them, this will largely be led through policy and peer influencing. They rarely get to influence into the supply chain.

Recalling Dr Nick Watts’ interview, we need to fully embrace the reality that up to 80% of all ESG impact occurs within the supply chain. In Greenhouse Gas (GHG) emissions terms, we’ve too long focussed on Scopes 1 and 2, avoiding the elephant in the room that is Scope 3 – for understandable reasons, complexity being one. We can argue that if every organisation effectively manages its own Scopes 1 and 2, then Scope 3 goes away, but pragmatic reality dictates that this won’t happen, at least not quickly enough if pressure is not exerted right through the market from top to bottom.

Procurement must play a leading role.

A DEARTH OF DATA

Modern organisations are data-led and rely on evidence-based decision making to move forward. Data is a business’s life blood and big data reigns. Without clear, reliable data, it is hard to prioritise and reach consensus, especially in larger organisations. Once a decision is made and action is taken, the feedback loop then doesn’t exist to reinforce the activity or stimulate a further change of course.

ESG data is notoriously inconsistent and unreliable. For many, this leads to frustration. For others, it opens up opportunities for false promises and greenwashing. In a recent stand against Greenwashing, Emma Howard Boyd, Chair of the Environment Agency, addressing the UK Centre for Greening Finance and Investment Annual Forum, warned that businesses are embedding liability and storing up risk for their investors by giving the false impression they are addressing the climate crisis.

“As with the government’s ambition for net zero by 2050, delivering on climate resilience and nature recovery requires robust, consistent, and trusted data,” 5 says Boyd.

Our analysis shows that there is a strong sense among Procurement Professionals that many of their suppliers are still ‘playing catch-up’ when it comes to understanding and measuring their own environmental footprint.

Among Procurement Professionals who are already taking steps to green their supply chain, over half (54%) feel there is a knowledge gap among suppliers, 40% have difficulties with monitoring fragmented suppliers, and over a third (35%) feel there is a lack of high-quality data. Significantly fewer than one in ten (8%) Procurement Professionals already greening their supply chain do not identify any challenges. In this nascent space, developments are clearly needed for supply chains to mature.

Q. WHAT ARE THE KEY CHALLENGES THAT YOU FACE IN IMPROVING THE SUSTAINABILITY OF YOUR SUPPLY CHAIN?

(Procurement Professionals)

FIGURE 9:

Procurement Professionals identify suppliers’ lack of knowledge around ESG as the key inhibitor to sustainability improvement – they also say that procurement incentives are generally not aligned to sustainability

This is particularly the case when it comes to smaller suppliers who will need more time to adapt to increased scrutiny. Small- and medium-sized businesses (SMEs) seldom get support from the corporations to which they sell, or from other supply chain partners to gear their business to better social or environmental standards. Likewise, financing options are not available to SMEs in the same way they are available to larger corporates. This is particularly the case for SMEs within emerging economies.

It is important that the additional focus procurement teams place on ESG results in meaningful action rather than increased administrative burden, and that there is an understanding that smaller firms may lack the know-how or resource to transition to more sustainable working practices. Of course, in forward-focussed businesses and teams, the actions of Procurement over the coming months and years should push suppliers in the value chain to become cleaner and more sustainable. Much of this will rely on innovative thinking, action, and technology. But suppliers must be given just time to innovate.

Actors in the supply chain will also benefit greatly from industry-wide collaboration (such as that from the Sustainable Procurement Pledge 6 ). Collaboration between larger organisations and small suppliers will be needed to facilitate knowledge sharing and effective use of technology and resources across supply chains in different geographies and sectors.

“Information is absolutely critical. Some industries have started introducing product passports – microchips that store all the information from the extraction of the raw material through to the final consumer good. But it is not cheap, and businesses have got consumers who are looking at the price of products and are prepared to switch to a competitor at the drop of a hat.”

A lack of value definition

We have seen from the data and interviews that ESG extends far beyond altruism – it has real value for organisations. Yet for many, a clear and consistent value definition is still lacking. Much like a lack of data inhibits progress, so does the lack of alignment on the relative benefits of different activities … or on the cost of progress.

Stronger rates of improvement have been seen when ESG has been translated to monetary values. For companies committed to net zero who pay to offset those emissions they cannot remove, there is a value per tonne of CO2 equivalent (tCOe). This allows a clear cost-benefit choice to be made: remove or offset.

Ultimately, sustainability done well can help reduce costs, increase revenues, increase margins, and improve access to cost-effective financing. We just need to find a way to quantify and acknowledge this value. For procurement teams, this means looking beyond “cost out” measures alone.

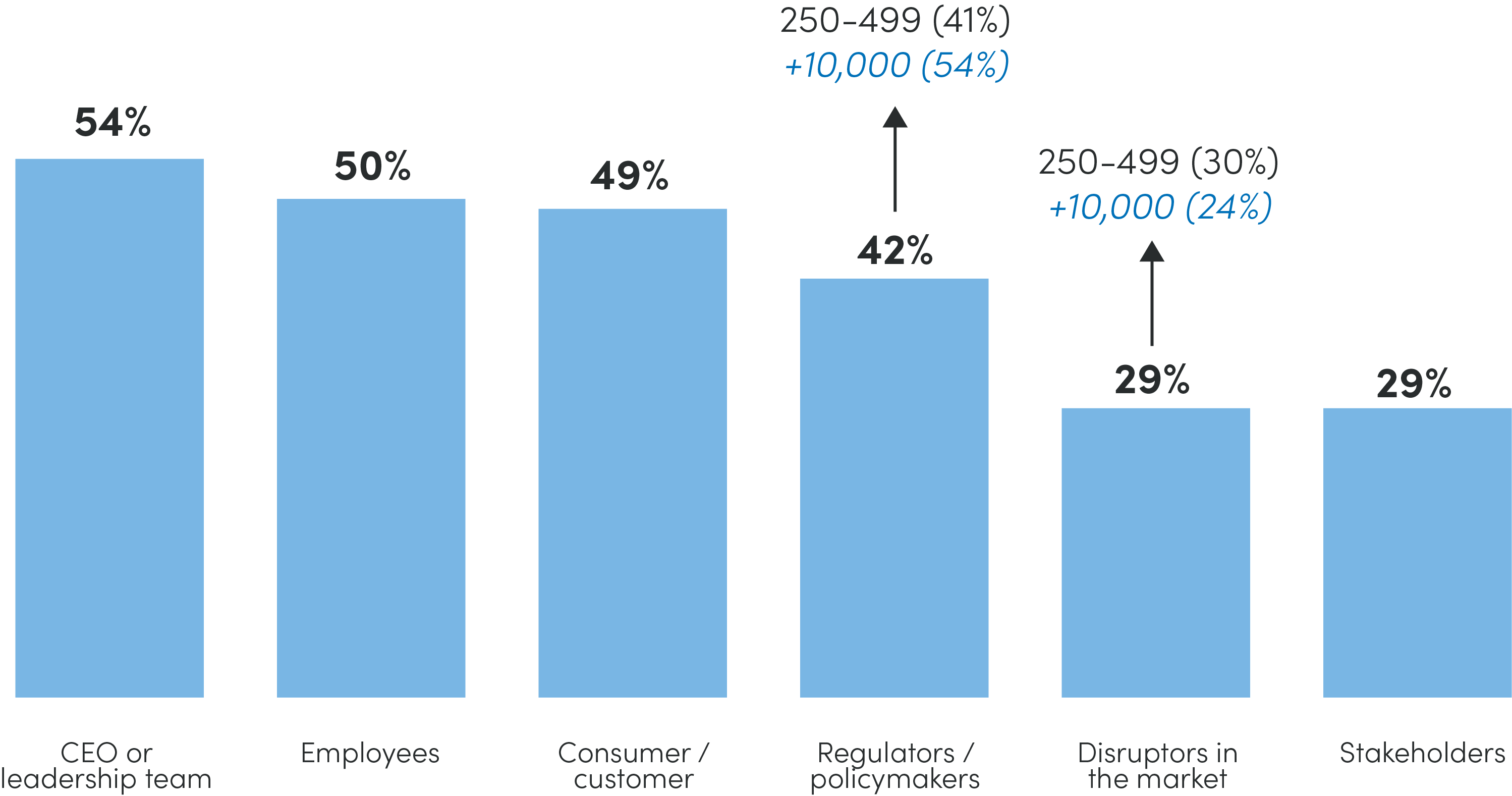

Our research indicates that business leaders see employees’ expectations and consumers’ demands as almost as important as the CEO’s vision in driving the organisation’s strategic priorities. Recall that talent retention was a key issue for businesses – if your business is not seen as doing the right thing, then talent will drop and in turn so will revenues and profit. Consumers will pay more and have greater brand loyalty for committed proponents of sustainability.

Q. WHICH OF THE FOLLOWING STAKEHOLDERS ARE THE KEY DRIVERS FOR YOUR ORGANISATIONS STRATEGIC PRIORITIES?

FIGURE 10:

Employees are almost as influential as leadership teams in defining strategy – interestingly, larger organisations feel much more impacted by regulation and policy than their smaller-sized peers

A lack of resource

Finally, we find there is a lack of resource and expertise to drive sustainability forwards.

Half of Procurement Professionals feel that recruiting and retaining people with the right skills and knowledge is one of the greatest challenges their teams are facing. In addition, almost one in three Procurement Professionals identify the lack of resource and investment as a key challenge.

Why is there a reluctance to invest in Procurement? Almost half of CPOs think that there is a lack of board-level buy-in and understanding as to what Procurement does. Those in the C-Suite are unlikely to think that allocating more resources to Procurement will support the sustainability agenda or make an impact on the success of the business as a whole.

They could not be more wrong. Investing in Procurement means empowering the function to attract visionary talent and expertise and evolve into a strategic driver of the organisation.

Q. WHAT ARE THE KEY CHALLENGES FACING YOUR TEAM?

FIGURE 11:

No matter the role or seniority level in Procurement, all parties agree that recruiting and retaining the right people is one of the top challenges, and almost half of CPOs experience a lack of board-level buy-in as to Procurement’s contribution and impact

4. The National Law Review, Ukraine Crisis Increases Supply Chain Cyber Risk, April 2022, Volume XII, Number 110

5. Finance, Resilience, Net Zero and Nature, speech by Emma Howard Boyd, Chair of the Environment Agency, July 2022

READ ON IN PART 3:

Unlocking the potential in procurement

CPOs have a strategic vision for Procurement’s wider remit, but they have yet to make the clear value case within teams and to leadership.

Continue reading Download the full report as a printable PDF